Acquiring CPA (Illinois) as a Canadian CPA, CA

Obtaining a CPA in the US under the reciprocity treaty is incredibly confusing, because there are a significant number of organizations involved and each one is only able to provide advice about jumping through the hoops that relate to them. There isn’t any single comprehensive write-up showing the steps involved, or what you’re signing yourself up for, even on anecdotal basis.

So I wrote this to share my experience. Please note that this is my experience at a single point in time, and while I do have some tips on how I think it could have been more efficient process, I am not making any guarantees as to whether my steps are still accurate or up-to-date. Responsibility falls on you to verify the current steps and requirements needed to obtain a CPA license in the USA.

Acknowledgements

Thanks goes out to Lynn Wu, Kathleen Park, Jonathan Chan, Chulin Geng, Yentl Tsui, Deron Fung, Yubo She and Steve Ip, past pioneers who contributed significantly in helping me figure out the process.

Things to Know

I’m a CPA that qualified under the legacy CA designation, having written the Uniform Evaluation (UFE). Prior to that, I graduated from the University of Waterloo, where the Math/CA and Master of Accounting program which let me write the UFE immediately after graduating without writing the Core Knowledge Exam (CKE) or School of Accountancy (SoA) - this will become important later.

Eligibility

CPA Canada has their own page listing the requirements to write the International Qualification Exam (IQEX) under the mutual recognition agreement, for the states that recognize the IQEX (not all states do!).

I qualified because under my legacy CA designation as I met the educational and examination requirements to perform audits in Ontario, by virtue of completing the Math/CA program + MAcc program + UFE, even though I never held or applied for a public accounting license.

If you wrote the CFE and didn’t choose audit as your elective depth role, you would not qualify as you didn’t meet the educational requirements to perform audits, unless you successfully complete the Post-Designation Public Accounting Module (8-week self-study course and 4.5 hour exam, at a cost of $1,300 CAD).

Costs

IQEX costs:

- $25 CAD to CPA Ontario for a Customized Letter of Good Standing

- $835 USD to NASBA to apply to write the International Qualification Exam (IQEX)

- $xx USD for a REG exam prep course for one month of study (I paid $67 USD to Ninja CPA)

- $25 USD to have NASBA send my IQEX exam score to the state board of my choice

Illinois-specific costs:

- $345 USD to ILBOE for a CPA Certificate

- $120 USD to IDFPR to apply for a CPA license, also good for about 3 years of licensure

My Experience

From start to finish, including study time and a lot of administrative wait time, it took me about 6 months to go through the process. I think it can be a lot faster on the licensure side now that the process isn’t a mystery on the licensure side, with the help of the notes I’ve embedded through my experience below.

NASBA Registration and Application

- 2020-12-03: Create an

online user account with NASBA

- Complete an application form “Apply Online”

- In the Attestation section, the bulletin that is linked is pretty useful, even if it was slightly outdated (e.g. it wasn’t updated for the current “continuous testing” that is done for the exam).

- Contact Information: Make sure your name matches what your identification says exactly or you could be kicked out of the writing centre if it doesn’t match. Unclear whether the address on the ID also has to match.

- Application Questions: There was a question asking ‘To which state do you plan to apply on your U.S. CPA license?’, note that your score is not automatically provided to the state you indicate here, I’m not sure if it even matters what you put here.

- Payment: $835 USD, my Canadian credit card was accepted for this payment.

- Following this you will have 30 days to complete your application, which is having CPA send a Letter of Good Standing in Step 2 below, or else your application and $835 USD fee will expire. If you are nervous about getting Step 2 completed before the 30 day deadline, it may be possible to complete Step 2 before applying for and paying for the IQEX in Step 1, you would ask NASBA at iqex@nasba.org to confirm if at all possible.

- 2020-12-04: Obtain a letter of good standing using a

specific form from NASBA, completed by the local CPA provincial/territorial body who must send it directly to NASBA. This was actually the most stressful step, I submitted a complaint and it seems to have been resolved on their end, but I’ll make note of some issues.

- To obtain this on the CPA Ontario website, I went to the CPA Ontario Portal and clicked View All under Member Requests, went down to Letter of Good Standing (Customized) which led to the CPA Store

- At the CPA Store, I selected the Detailed Letter of Good Standing $25.00 and in the Purchase Comments, I added the following note:

“Would you please complete the Letter of Good Standing and forward directly to iqex@nasba.org and CC my email: ____________?

«I also inserted a link of the NASBA form pre-filled with my info where indicated and signed with ink»”

- If you are a graduate of the University of Waterloo and were therefore exempt from the CKE and SoA, I’d suggest adding a note reminding CPA Ontario that you meet the educational requirements to perform audits, because you completed the UFE and you attended the programs at the University of Waterloo that granted an exemption from the CKE/SOA.

- I had an issue where CPA Ontario sent the letter stating that I did not meet the requirements, because the CPA Ontario employee didn’t realize there was an exemption for UWaterloo graduates from taking the CKE and SoA. It’s a long story. I complained to CPA Ontario and hopefully this is not an issue for anyone else anymore.

- The timeframe for this appears to be 1-2 weeks based on my classmates’ experience before and after me, but took me the full 4 weeks. Make sure you follow up by phone or by email. The contact at CPA Ontario running this request is at ROMembershipteam@cpaontario.ca who you can also submit your pre-filled NASBA form to if you hadn’t originally.

- Based on my emails with iqex@nasba.org, it appears that the administrator (who is amazingly prompt at responding to emails) has the discretion of extending the deadline for the Letter of Good Standing by an additional few days.

- 2020-12-30: CPA Ontario sent the correct letter of good standing

- 2021-01-05: NASBA confirmed that the evaluation of my application was complete. In general, processing on NASBA’s side was prompt and with sufficient communication.

- 2021-01-07: Email from ‘NASBA Automated Systems’ with Jurisdiction Candidate ID and instructions on how to access my Notice to Schedule. Make sure that you remember your security questions, as I found that I was occassionally asked when logging into the CPA Candidate Portal on the NASBA Site. Given 6 months from date of issuance to write the IQEX.

- 2021-01-16: Using information from Notice to Schedule, booked an exam timeslot early on Prometric since timeslots filled up quickly because of social distancing during COVID

- Booked 2021-03-03 as exam date, in Hamilton, which was the closest and earliest timeslot available because of COVID lockdowns in Toronto. Note that there are both morning and afternoon start times available at different writing centres.

International Qualification Exam (IQEX)

Content

The IQEX is essentially the REG CPA Exam that is one part of the series of four exams that Americans write through their normal licensing process. A significant amount of the content is on US Federal Taxation, with the remainder on business law, ethics and contract law.

While a fair amount of content is on the exam, the exam seems to focus in on certain major topics. This is not dissimilar from the UFE / CFE, where common topics like revenue recognition were tested every year. Therefore, focusing on the major topics (e.g. basis of property) and not getting lost in the details (2 full pages of miniscule text about Roth IRA’s) helped me study more strategically.

Format

The exam is 4 hours, subdivided into 5 testlets of questions. What that means, is that when you complete a testlet and proceed, that you can’t go back to that or any other previous testlet. Breaks are available between testlets, some which will count against the 4 hour time limit, and some which don’t.

The questions are all designed to be auto-marked, so they are all either multiple choice questions (MCQs) or the scary-sounding task-based simulations (TBS). TBS are not actually actually scary, they are really just a series of fill-in-the-blank questions tied together with a common theme or scenario. One of the TBS may take the form of a research question, which means they’ll ask you to provide the Internal Revenue Code (IRC) reference for a specific item (the IRC with full search functionality and headings/subheadings is provided for that testlet). I did find the IRC a lot easier to read than the Income Tax Act (Canada), and I’ll even admit that the first time I cracked open the IRC was on the exam (and I found it too).

Additionally, the computer will adapt to your performance after the first testlet and increase the difficulty level if you do well. Marking is not linear (e.g. 70 correct out of 100 =/= 70%), but that it’s known that questions have different weighting depending on their difficulty. This isn’t dissimilar from other exams like the GMAT.

I highly encourage taking a look at the REG sample test available on the AICPA website to get an idea of the format. I’ll note also that the research question in the sample test is significantly more difficult in the AICPA sample exam than what I think it would usually be.

Unlike the UFE / CFE, I don’t think it is an issue to burn a sample test, because you will practice through endless amounts of MCQs where you will learn through repetition. It is not at all like a case-based exam where a limited number of practice exams exist.

Scheduling

The IQEX has moved very recently to continuous testing in July 2020, which means that the IQEX is available to be written year-round. Previously, there were testing windows only available for a couple months every season - if you’re reading about testing windows on another site, that means it’s outdated information. They can be written at ProMetric testing centres, which are widely available in Canada/USA and are filled with people simultaneously writing other exams - what this means is that unlike the experience of writing the UFE or CFE with a lot of other prospective accountants, that you can prepare and write for the exam on your own schedule and that your neighbours at the testing centre will be writing a different exam.

Prometric has a availability search tool that shows nearby writing centres and dates available, for browsing even without a Notice to Schedule.

Difficulty

Personally, I did not find the test difficult, though it likely helped to have a tax background, including working with multinational corporations that do operate in the USA. I scored a 92 after about 150 hours of study. I also finished the exam early by a significant amount of time.

Irrespective of background, I think it is easier to learn a different tax system for the second time, because the basics of income taxation already exist - while I might not have known right away know how to calculate the US equivalent of taxable income, taxes, tax credits or tax deductions, the overall structure of income taxation is very similar and at that point it’s just a matter of putting the pieces in the right places.

I always compare different tax systems to board games. Learning a new concept in tax is like playing a new boardgame in the same genre as other board games you’ve played before - the new boardgame will have many similar concepts and moving parts as those other board games so it’s faster and easier for you to wrap your head around it than the first time you tried.

Preparation Courses

There are a number of different prep courses that are available, and I will mention the ones that I used on both a paid or trial basis. While there are prep courses that assist people specifically taking the IQEX, I didn’t feel like I needed that (nor did I want to pay the much higher cost).

I was told by a previous writer that the most important part of preparing for the exam was repetition from practicing MCQs over and over and over again, and having gone through the process I couldn’t agree more! The constant repetition and exposure the most important issues really helps to improve memory retention - regardless of prep course, I think it’s helpful to reinforce readings with MCQs right away of that section.

I think it’s important to note that many prep courses use the same questions - that is, questions used in previous AICPA exams that have been released to the public. What differentiates each one is the additional material explaining the correct answer, and links/reference to study material.

Most courses have specifically designed their exam bank section to closely emulate the look and feel of the actual exam, including availability of a basic spreadsheet and calculator. All of the ones I tested claimed to track your past results and adapt the questions they give you to improve retention.

Unlike many sites recommending prep courses, I do not use any affiliate linking or receive any kickbacks from these prep courses.

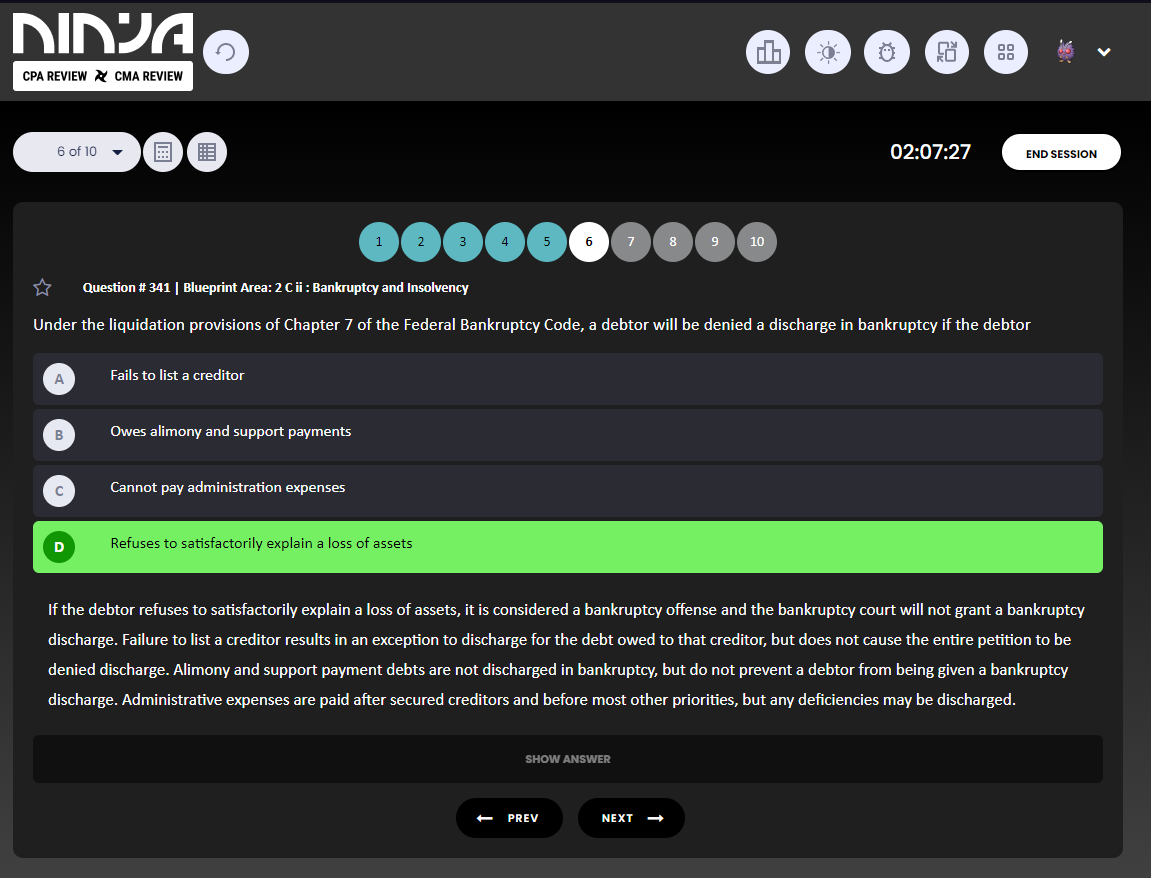

Ninja CPA

- No trial available

- $67 USD per month with full access to notes, videos, podcasts and question bank

- Monthly price charged until you cancel, access still available after cancellation to the end of the monthly period

- PDF notes, PDF book, audio, flashcards, videos and testbank

- Dark mode available on website

Ninja CPA was the main prep course that I used to prepare for the US CPA exam, and I will admit that I chose it because it was the cheapest, at a price of $67 USD for the one month (Feb 2021) I needed access since I had set aside an entire month exclusively for studying the exam.

Overall, I felt as though it significantly covered all the areas on the exam and focused particularly on the important areas. The examples were helpful in illustrating concepts immediately after they were covered. Infrequently, I wish the book would go a bit further in-depth, or better explain certain concepts since I was learning them for the first time. But I didn’t find it to be much of an issue because anything that needed further clarification I found from watching the Ninja CPA videos first, doing a quick Google search, or from Farhat’s Lectures. I didn’t refer to the PDF notes in my study plan, only the PDF book, so I can’t comment on the notes.

There were a couple inconsistences that I noted, my email/support ticket recommending clarification to the PDF book was never responded to and my colleague’s post in the forum asking for clarification with an issue in the PDF book was never responded to. Maybe there’d be more luck of live help in one of the live sessions, “REG Sparring”, which occurs weekly. Unfortunately, the live session was cancelled for two of the weeks that I was studying, but after looking at one of the recordings, I don’t think it fits my own personal learning style since the testbank’s explanation in debriefing was thorough enough for me already, I didn’t feel like I needed the extra help of someone explaining it.

The entire website is available in dark mode, which is amazing if you find light layouts to be too harsh on the eyes. It also displays well on mobile, so you can do MCQs while in bed at night (don’t do that!). The test bank tracks performance by each part of the test and provides a number of fun statistics you can check. There’s even a fun leaderboard you can compare your performance against others doing practice questions. I appreciated that everything about sessions was configuring, from the number of questions, which parts of the exams were tested, whether you wanted instant feedback or not, timed functions, etc.

I found that the explanations were good in explaining why the answer was correct, and sometimes there were also explanations on why the other answers were wrong (or what you might have done to get to the wrong answer). Every question was accompanied by the part of the exam that it was related to - this is not immediately obvious, but it’s at the top of each question.

The whole ninja theme I don’t care much for, but it definitely does differentiate them in a field of competitors with staid offerings from large institutional publishers.

Surgent

-

Free Trial period available for 14 days, no credit card needed

- Free trial includes full access to PDF textbook and exam bank

- Course cost $599 USD

I dabbled briefly in this, they have a very very extensive 300+ page PDF book that summarizes all the topic in point-form. I did find the amount of detail to be overwhelming when I was looking through it. Don’t open this PDF for the first time a couple days before the exam.

Wiley

I spent a little time using Wiley’s free trial, their MCQs have excellent linking from the answers to the source material/IRC references. However, it was frustrating that clicking on an answer in multiple choice resulted in the answer being scored right away (no submit button), since I like clicking through the answers as I read them.

My Thoughts on Study Strategies for the IQEX

There are two distinctly different types of content on the exam, which I’d summarize as tax and not-tax.

It seems the majority of study materials start off with the not-tax and finishes with the tax. I found it really easy to get bogged down by trying to read through the not-tax content, and found it much easier to start with tax content instead.

The not-tax content, I found was easier to learn through videos (from a prep course or YouTube), mostly because I could spend a lot of time reading and not absorbing much information at all. It’s also worth less than the tax content. I found it helpful to focus on learning what came up in the MCQs.

The tax content is far less abstract, easier to digest and make up the majority of the content. It’s easy to pickup from videos, reading and constant repetition from hitting the test bank over and over again. As I mentioned before, Farhat’s Lectures was a great way to make my YouTube time more productive.

Exam Results

Exam results are released in batches. Unlike the CFE / UFE, numerical scores out of 100 are also provided. The cutoff dates for each batch are listed on this AICPA page. If your exam date is after a cutoff date, you could be waiting as long as a month and a half for your result.

2021-03-18: My exam score was released on NASBA’s Candidate Portal in the morning of the release date, even though others discussing online said they were normally posted in the evening.

Applying to Illinois

And so begins the state-specific content of my experience… as far as I’m aware, Illinois was the simplest to meet when I applied as it didn’t require the assessment of any post-secondary transcripts or additional courses (like ethics, or to bump up the number of course credits). It only required the completion of the IQEX (and that therefore you meet the requirements of the IQEX) and verification of one year of work experience. However,people who move to the USA might be required to get a license in the state that they practice in.

CPA Certificate vs CPA License

There’s actually two steps before you can put CPA (Illinois) after your name. The CPA certificate is the preliminary step, where the Illinois Board of Examiners confirms that you meet the educational requirements for the CPA license, and comes with its own fancy wall certificate. Once certified, a candidate is allowed to state that they have “Successfully completed the CPA exam…”.

The actual and final CPA license process is managed by the Illinois Department of Financial and Professional Regulation.

There is also a separate Illinois CPA Society that is not part of the licensing process, instead it is the professional association that represents CPAs licensed in Illinois. Membership in the society is optional.

Obtaining the CPA Certificate (Illinois)

Registration with ILBOE

As of the time of writing, the process for applying for a certificate to the Illinois Board of Examiners was listed under IQEX Application Process.

I registered with ILBOE on 2021-03-18.

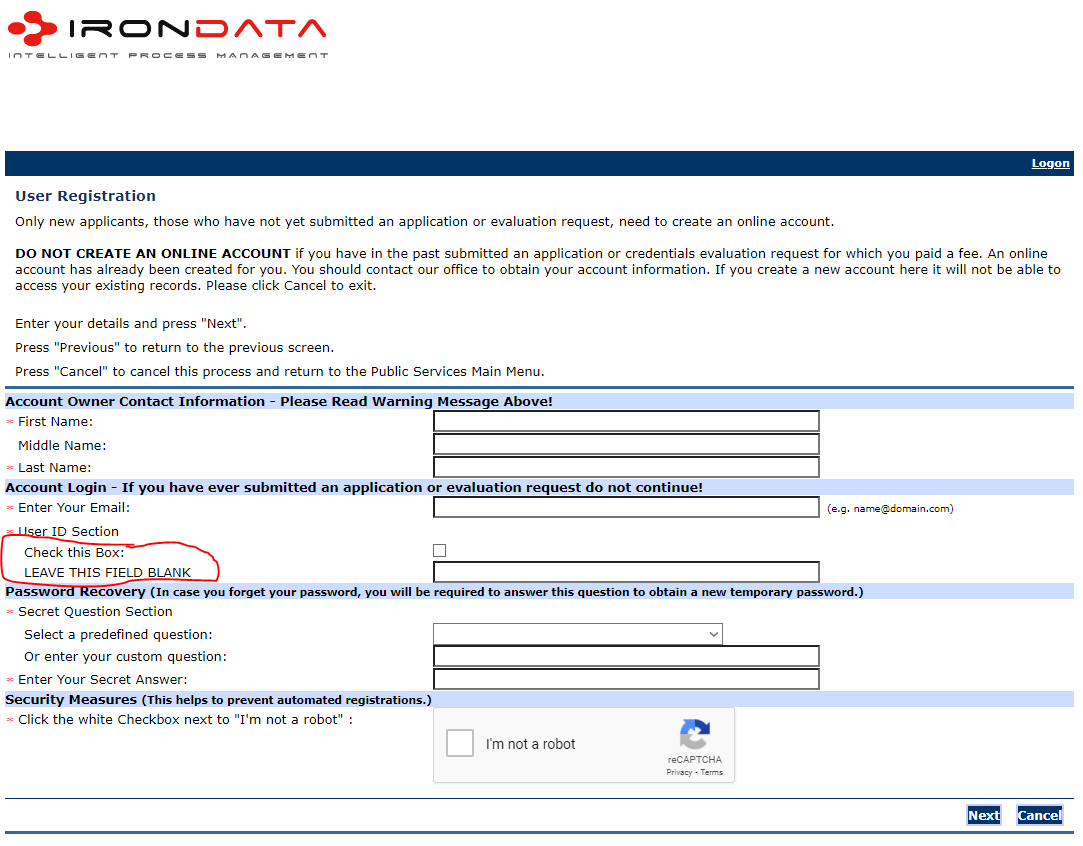

- I went to create an account

- The next page is pretty amusing, as it seems to test your reading comprehension skills with prompts like “Check this box:” and “LEAVE THIS FIELD BLANK”. I can’t help but share a screenshot of this.

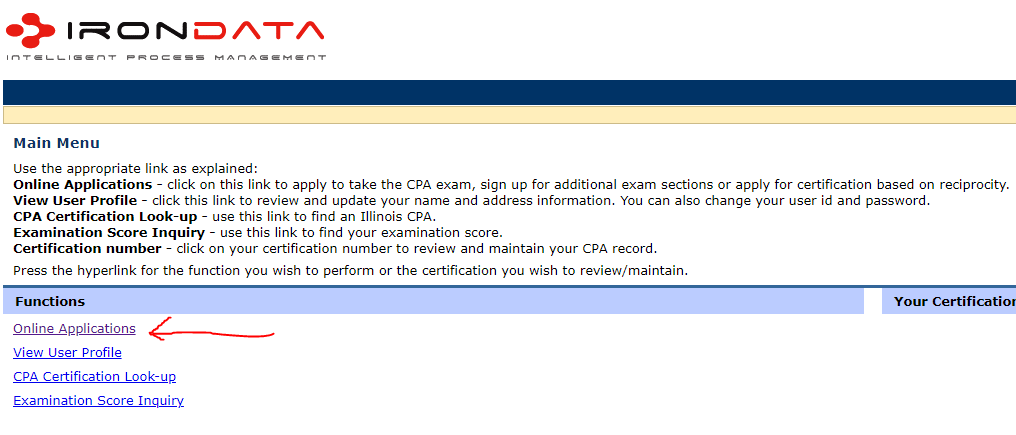

- After registering, I had to log in again to my account, then click Online Applications.

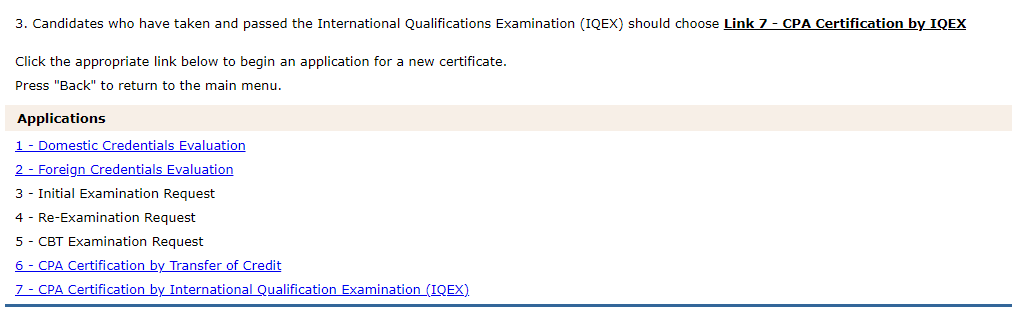

- Then I selected ‘7 - CPA Certification by International Qualification Exam’ at the bottom of the page.

- After entering personal information, it prompted to enter my Address, hitting ‘Add’ allowed me to add my address information, the ‘Next’ button is misleading as it moves onto the next section.

- The next screen I was asked for my IQEX Candidate Number, which was my National Candidate ID, which I found on my Notice to Schedule, or at the top left of the NASBA portal when logged in.

- I completed the rest of the application and paid $345 USD online by Credit Card.

Transfer IQEX Score from NASBA to ILBOE

I paid NASBA to transfer my IQEX score to ILBOE on 2021-03-18.

- I went to NASBAStore and registered a new account (it is not linked to your NASBA account created earlier).

- I added to cart the NASBA Candidate Score Transfer. In the From Jurisdiction field I chose IQEX (bottom of the list) and for To Jurisdiction, I chose Illinois.

- The instructions were very clear in the description of the item to use their address as the shipping address, to waive the international shipping fees (there is nothing actually physically shipped in this order).

- Checkout and pay the $25 USD fee by credit card to NASBA. Watch out, if there are ~$100 USD of shipping charges, check to make sure that the shipping address is the one provided by NASBA.

On 2021-03-26, I had already received an email from the Illinois Board of Examiners congratulating me on my CPA Certificate, including a PDF letter with my certificate number and date of issues. I later received by mail a paper copy of the CPA certificate.

Obtaining the CPA License (Illinois)

The Illinois licensure process is administered by the Illinois Department of Financial and Professional Regulation (IDFPR), which administers the regulation, of well, basically everything that requires regulation in Illinois, so understandably they don’t have very much insight into specifically how the CPA licensure process works for foreign / IQEX candidates.

Some useful links below about this process:

- IDFPR Online Services Portal

- Licensed Certified Public Accountant Application Checklist (contains the work experience verification form, but not the paper application)

- IDFPR Contact Page, including Phone Number (uses a 1-800 number so you can call toll-free from Canada)

- Email for Professional Regulation

Online Application with SSN

For those with an SSN, the application is submitted online by form and uploading of the signed work experience verification form, including payment through a portal online with a credit card.

Paper Application Without SSN

Since I did not have an SSN, the process was much more difficult because I had to do a paper application accompanied by a $USD money order payable by a US bank.

The strange part about this was that based on the feedback of people (without SSN) who did it less than a year before me, was that the application process was online and that they were able to pay by credit card through an online portal for the licensing fees. After trying to pursue this angle with the call centre and Jim Koehl, a manager in the Division of Professional Regulation, I was unsuccessful and ended up submitting a paper application with a $USD money order.

The paper application I submitted was based off of a PDF I received from Jim Koehl, a manager at the Division of Professional Regulation. I’ve uploaded on my website the copy I received on 2021-04-08 here because it does not appear to be available anywhere on their website, but I suggest that you confirm with the general email contact if it is still the correct version to use before submitting. Also note that I was directed to mail to a different mailing address than shown on the linked PDF, so I would suggest confirming the mailing address as well which I’ve included below.

The following items were included in my paper application:

-

A cover letter I made that listed my ILBOE CPA Certificate, and also noted the 9-digit US routing number on my $USD money order. It also contained all my contact information.

-

Pages 5-8 from the linked PDF completed electronically with my own information using a PDF editor, in particular:

- Listing my CPA Ontario number on Part IV: Record of Licensure Information

- Listing the IQEX on Part V: Record of Examination, with N/A - NASBA listed as State and PASSED as Exam Results

- Signed in ink on the final page

-

Verification of Employment/Experience, which I had signed by a senior manager at my previous workplace. According to the IDFPR, it does not have to be signed by a current CPA (Canada or US) or an accounting firm partner, just that the person had to be a supervisor

-

Affidavit - Social Security Number, in particular I put in the explanation:

- I hereby certify that I do not have a social security number because I am a Canadian citizen. I am not a US person. I have never worked in, nor lived in the USA. I am not eligible for an SSN.

-

$120 $USD money order, as credit card is only accepted for online applications, I have notes on this below in the next section.

I did not include any of the other forms, in particular:

- Certification by Licensing Agency / Board: I think this form is for an applicant from another state

- Public Accounting Continuing Professional Education Reportin Form: This seems to only be required where a significant gap between the CPA exam and application for licensure exists, which didn’t apply to me.

Payment for the Licensing Fee

As I mentioned before a $USD money order has to be (quote) ‘payable through a US bank with a 9 digit routing number’. After going back and forth for almost a month with Jim, he changed his wording to drawn on a US bank with a 9-digit routing number. I’m not sure if that means anything different, but I noticed that the $USD money order from BMO and TD should work because they list US banks, and they ultimately did work because they were both processed by the IDFPR.

TD’s $USD money order says To: Wells Fargo Bank, N.A. and has the routing number 041203824 listed on the bottom amongst other numbers. TD will issue a free USD money order if you have a TD All-Inclusive chequing account, but the balance needs to come from a $CAD or $USD account which requires foreign exchange fees from $CAD, or the $USD accounts have monthly fees for unlimited transaction, or a per transaction cost.

BMO’s $USD money order says To: BMO Harris Bank N.A. and has the routing number 071000288 listed on the bottom amongst other numbers, BMO Harris Bank N.A. is a United States bank and is a subsidiary of the Bank of Montreal. The USD money order can be withdrawn from BMO’s premium USD chequing account with no fees (the BMO premium chequing account has no fees if the minimum balance is met).

The $USD money order was made out to “IDFPR”, which I had confirmed at the time by calling the IDFPR’s general call centre. According to BMO, unlike a cheque they weren’t able to confirm whether or not the $USD money order was cashed, unless they performed a trace.

Mailing

The paper application has instructions that include a mailing address to mail the paper application, supporting documentation and payment, but Jim had asked me to mail it to the following address for him to handle directly. Definitely an item that should be confirmed before mailing.

ILLINOIS DEPARTMENT OF FINANCIAL AND PROFESSIONAL REGULATION

DIVISION OF PROFESSIONAL REGULATION

JIM KOEHL

PSS

320 W WASHINGTON ST, 3RD FL

SPRINGFIELD IL 62786

2021-04-22: I sent my paper application by regular mail (~$1.50 CAD) and confirmed receipt with Jim by email, but I probably should have sent the application by registered mail (~$30 CAD).

CPA Exam Scores Received

2021-04-23: An automated email is sent out by the IDFPR once the IDFPR receives the information about the CPA certificate from ILBOE. While it did prompt me to create an account online with a link and brief instructions, I was still not able to create an account online without a SSN and had to rely on my paper application to be processed.

Checking on the Status of the Application

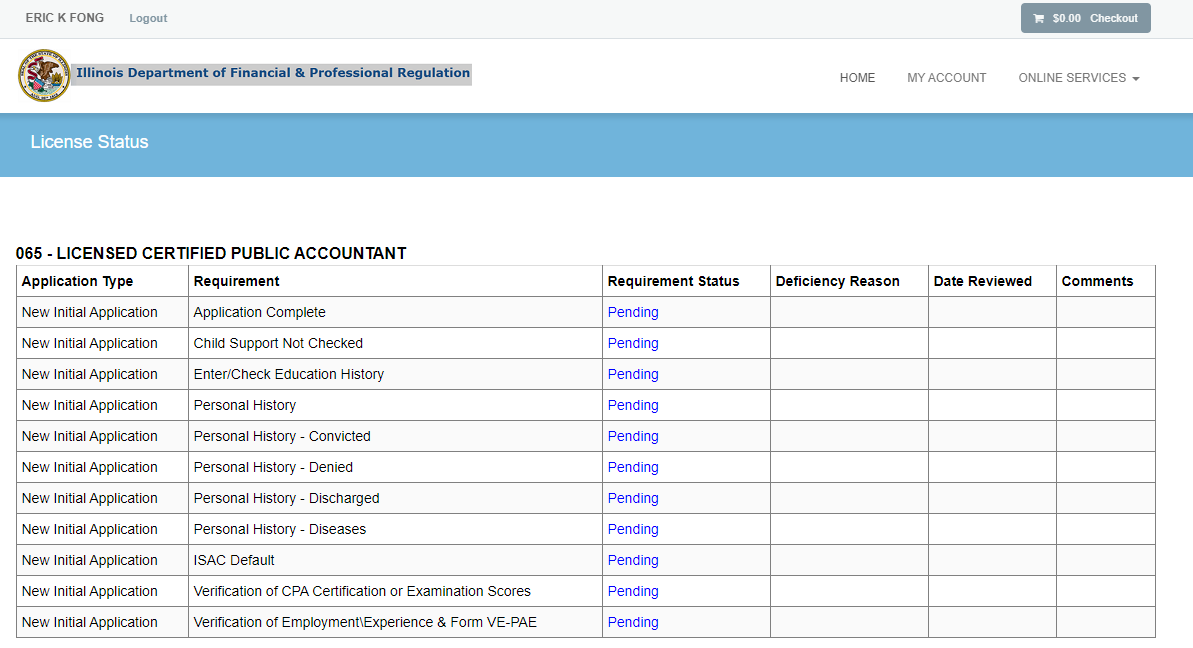

2021-06-10: About 2-4 weeks after mailing the application in, the payment will be processed and the application will be sent for processing. At this point, I was able to call into the general call centre for the IDFPR at their toll-free number (1-888-473-4858), to check on the status of my application. The phone agent is incredibly helpful and was also able to walk me through setting up an online account - now that I was “in the system”. Internally that meant they had assigned me a fake SSN (it starts with 9, which is reserved for ITINs), which they gave to me on the phone as part of the account creation process in order to register. Checking on the site isn’t actually useful, since I suspect it just shows everything as Pending until submitted.

With the online account, I was able to check the status of my request

Success!

2021-06-17: License was active and appeared on the License look-up page on the IDFPR site.

2021-06-24: Received an email ‘IDFPR Electronic License Retrieval Notification’ which was amusingly very uncongratulatory and had instructions on how to view and print the CPA license. According to the email, the IDFPR has gone paperless, so no paper license will be mailed out unfortunately. The PDF license comes with a QR code and a dotted line to cut along.

Hopefully this write-up is helpful to any future Canadian CPAs looking for some info on getting licensed in the US!

Timeline

- 2020-12-03: Applied to NASBA to write International Qualification Exam (IQEX)

- 2020-12-04: Requested a Customized Letter of Good Standing from CPA Ontario

- 2020-12-30: Received Customized Letter of Good Standing from CPA Ontario

- 2021-01-05: NASBA confirms that evaluation of my IQEX was complete

- 2021-01-07: NASBA issues a Notice to Schedule

- 2021-01-16: Booked exam date of 2021-03-03 on ProMetric site

- 2021-03-03: Wrote the IQEX

- 2021-03-18: IQEX scores were released for exams written on or before 2021-03-10

- 2021-03-18: Registered with Illinois Board of Examiners (ILBOE)

- 2021-03-26: Received PDF letter by email congratulating me on CPA certificate

- 2021-04-22: Mailed paper application to Illinois Department of Financial and Professional Regulation (IDFPR)

- 2021-06-10: Registered